That we’re still discussing the US/China relationship, especially the trade front, should not be a surprise. What is a surprise is the one-dimensional perspective commentators take. To us, this is nothing like a conventional trade war, and instead is the predictable “conflict of self interests”; a path that the two superpowers have long been on. While many wonder which “nuclear core” will burn down through the Earth first, few recognize that it’s precisely these risks that offer the greatest chance that détente will remain the steady state. Thucydides and his trap, will have to wait.

Summary

- Most commentators understand very little about China, basing their ideas on outdated myths.

- Even less is understood about Trump’s strategy towards China

- We feel the reality is simpler – Xi and Trump both understand their rival far better than commentators assume

- And neither man has the strength to press home any advantage

- President Xi has the weaker hand, given his recent adoption of new powers and the shaky Chinese economy.

- Trump also has weakness at home – loss of the House and a battle over the government shutdown

- China is more likely to comply and eventually “fold”

- The victory will be phantom, a détente – “Ok Donald, let’s say you won”.

- Lessons from this “skirmish” will be useful in the future, as the real battle for technological supremacy is fought out.

- Trump’s strategy is built upon re-establishing the “American-ness” of the multinationals, rather than facing China toe-to-toe – Make Multi-nationals American Again.

- China and Xi are focussed on ensuring technology arrives in time to protect the party from the people, giving Xi’s “reforms” a chance to succeed.

China, China, China, China, China… China

Any discussion about US policy towards China, at least since Trump, should begin with this.

Ok, if you lasted the full 1-44 of that clip, hopefully you’re still with us.

Why the joke? because a lot of what’s written, said, and of course believed, on the US stance towards China resembles that rap. Indeed, if there were an equivalent rap summing up how China, and Premier Xi thinks about the US, we’d have posted that alongside. There isn’t. Instead, there’s this.

In this note we’ll explore the current state of the relationship, why it confounds so many commentators (by design) and offer an optimistic view of how the relationship will impact markets this coming year.

We’ll spilt it into three acts – the Chinese side, the American side, and the Conclusion – détente.

Act One – China’s Syndrome

The impact of the French Revolution? “Too early to say.”

We can’t indulge in the full extent of a relationship that goes back a hundred years, and has been on a very direct path of collision throughout. Instead we’ll begin with a story.

When then-Premier Zhou Enlai was asked about his impression of the importance of the French Revolution, he simply stated “it’s far too early to tell”. From this comment, many have perceived China’s whole foreign policy as long term and patient. For decades this comment was used to authenticate the Western view that China was insular and long term. She would remain dedicated to “tending her own garden”, and only gradually reappear as a force in the World at large.

Sadly, like all the really useful and amusing tales that sum up the human disorder, it’s been “proven” to be a mistake. As the story goes “The trouble is that Zhou was not referring to the 1789 storming of the Bastille in a discussion with Richard Nixon … Zhou’s answer related to events only three years earlier – the 1968 students’ riots in Paris, according to Nixon’s interpreter at the time. …At a seminar in Washington to mark the publication of Henry Kissinger’s book, On China, Chas Freeman, a retired foreign service officer, sought to correct the long-standing error. I distinctly remember the exchange. There was a mis-understanding that was too delicious to invite correction,” said Mr Freeman.”

France seems to be in turmoil, bordering on revolution, so regularly, that like busses, if you missed one you won’t have long to wait for the next. So it’s forgivable that this mistake took so long to correct. But the admission seems to us to assimilate the West’s total misunderstanding of the Middle Kingdom. Rather than going there themselves and finding out, many scholars and policymakers have used these “rules of thumb”.

If they had have visited, at least since the Chinese decision to re-enter the global economy with the devaluation in 1993, they would have found a swan.

Serene on the surface, …………paddling like fury beneath.

When you have over a billion mouths to feed and a history almost as bus-like as France, the leadership paddle fast.

So when did the swan turn Black?

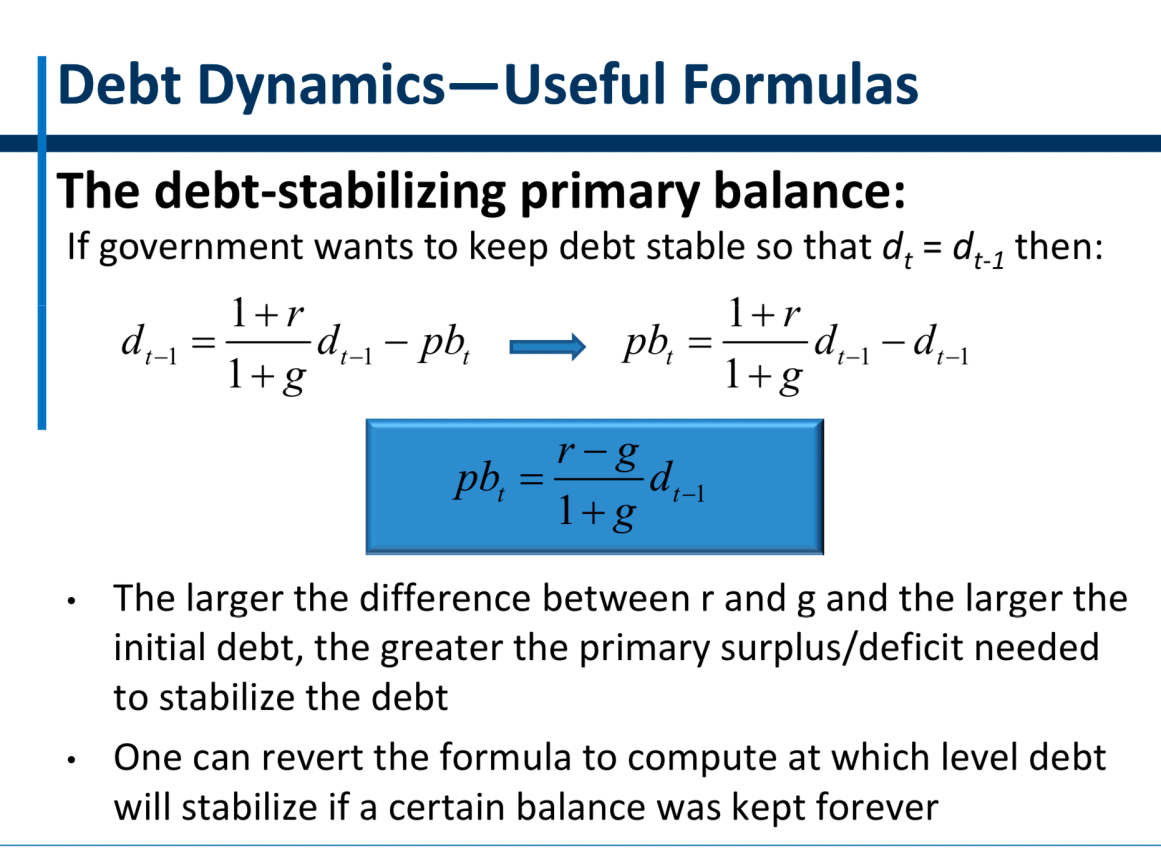

Most (even perhaps President Xi) see China as a Black Swan – either an economy built upon debt and shadow banking, which is reaching it’s financial limits, as the “debt equation” explodes,

or a dark shadow of a superpower that is ready to embark upon empire.

Both ideals could be true. But we instead see a China that is just trying to stay in one piece, keep civil order, and brace itself for the inevitable technological changes that are exogenous to all, including themselves.

They’re just trying to stay afloat.

What evidence do we have that they say what they mean?

Well for a start, the Chinese leadership is going back to basics to try to understand themselves. They are reading Alexis de Tocqueville.

But before you imagine they are reading de Tocqueville’s Democracy in America to attempt to understand America, a treatise that most American scholars still view as the best way to understand the America of the Founding fathers, hang tight.

No, they are reading The Old Regime and the Revolution, the French historian’s treatise on the 1790s French Revolution.

Another of Tocqueville’s conclusions was that a regime with centralised power actually intensified tensions between social classes. The French political system had placed executive, legislative and judicial powers under centralised authority before the old regime was toppled.

Today’s China, with its system of one-party rule, is seen by some as the modern-day equivalent. Many academics say the party’s monopoly on power is the chief reason behind China’s widening wealth gap, rampant corruption and abuse of power by officials – all major sources of public dissatisfaction with the government.

But the most discomforting of Tocqueville’s conclusions for China’s leaders is that the “most dangerous moment for a bad government is when it begins to reform”.

“It is almost never when a state of things is the most detestable that it is smashed, but when, beginning to improve, it permits men to breathe, to reflect, to communicate their thoughts with each other, and to gauge by what they already have the extent of their rights and their grievances. The weight, although less heavy, seems then all the more unbearable,” Tocqueville wrote.

If this is what Wang Qishan, Xi’s most trusted righthand man, is admitting to reading only 5yrs ago, could China’s preferred focus still be internal stability ?

And what of the American attempt to understand China.

It’s evolved. As China has opened up, Western capitalists like the two Henrys, Kissinger and Paulson, have reassessed their own experiences, and written books. Academics have mingled, even studying in China. Niall Ferguson (visiting professor at Tsinghua University, Beijing) comes to mind, but there are many. And of course, financial analysts, much versed in China’s evolving and kaleidoscopic financial system, have written of its pending apocalypse. An old friend, seasoned and respected, George Magnus, is the latest to pen the poison.

They could all be right.

Swan-dive

But what matters most at this juncture, is the Trump administration’s approach to China. Like its approach to almost everything else, from foreign policy to immigration and abortion, it has looked like a swan swimming upside down – frantic flailing of the fins above the water, but serene and accomplished below. We tried to explain this in the footnotes in here, suggesting that we need to ignore the white noise and kabuki theatre, and instead focus on the “Shakespeare” – the real plot behind the scenes.

When we saw the appointment of Robert Lightheiser, alongside the China-bashers, we saw a consistent strategy. Loads of white noise, some kabuki , but behind all the sabre rattling, a clear and business-like strategy led by a man who has read a few (thousand page) trade agreements.

And that’s what we continue to see. Trump wants a deal, and a deal that is at least as good as the one Micky Kantor won from the Japanese in 1995. Then, amidst a formal dollar crisis triggered by Fed rate hikes that broke the Mexican fx-policy, the US played out a weak hand and the Japanese, led by soon-to-be-PM Hashimoto, declared “OK Micky, let’s say you won”.

“I’m not the theatrical type. The art of persuasion is knowing where the leverage is.”

The manner of the current negotiations, with new meetings likely set for the end of January, is classic Lighteizer. He, and the US administration, know full well that the slowing of the Chinese economy, together with domestic uncertainty regarding the leadership status of President Xi, provides unusual leverage. This leverage could disappear, and needs to be exploited now. The US administration knows that, and are ruthlessly setting out to do just that.

Third time’s a charm?

The Chinese economy, version 1.3, is no spring chicken.

Version 1.1 (post-Ziang Zemin’s devaluation – 1993-2001) saw the economy broaden into a global trader and industrial powerhouse, based upon lowest cost of production. Version 1.2 (Hua Jintao 2002-2012) saw the import of technology via multinational companies (think Apple) and the maturing of the economy. Hua had already planned to implement a transition away from trade towards consumption, but the excesses of previous regimes had built to such an extent that he never saw the reforms through. That said, the economy effectively doubled in size under Hua. China had arrived.

Version 1.3, which we’re see evolving today (2012-) starts with Xi digging the spinning wheels out of the mud of corruption. The purges, which saw Bo Xilai and others imprisoned or executed, delayed his intended strategy. He ran out of time, and therefore needs an extra 5 years to implement his plans. Far from attempting “Deng-like emperorship” he simply needs more time. The Party has given him it. If they’ve given him life rule, they don’t know it yet.

Inside the Mind of Xi

One can never know what goes on inside the mind of a man who’s responsible for 1+ billion souls. One studies his suits, his ties, his comments, and his smile (or frown). But it’s impossible. No less for the likes of President Trump.

But we all try. and we have found this book to provide the best guide to the man and the mission. And of course, it’s written by another Frenchman.

We could attempt to summarize it, but why bother – we’d strongly suggest read it. However, if you must have a summary, this is pretty good;

“Xi Jinping wants to become the world’s most powerful leader. To succeed, he must balance Mao’s Little Red Bookwith the Analects of Confucius, and more. For Xi, the task ahead of China is to preserve the guiding ideology of Marxism, while challenging mistaken credos like neoliberalism, constitutional democracy, and ‘universal values’. China must have total faith in its own brand of socialism, blended meaningfully with Chinese tradition. And this system must revolve around one man–around Xi and ‘Xi-ism’. François Bougon’s compelling biography exposes the historical, philosophical, political and personal narratives that Xi has skilfully woven together to create a superpower in his own image. Is Xi’s China a land of ‘new market totalitarianism’? Will this be the price of the Chinese dream?”

When we read it, we were left with one conclusion; Xi’s strength and fortitude is like no other Chinese Leader, built upon his youth in the “Yellow Earth” of Mao’s villages, and steeped in the pride of his forebears, particularly his father, one of Mao’s companions on the great marches. He is a master strategist, understands history and it’s power, and will heed it’s lessons before that of any advisor. He is pragmatic, yet ruthless. He is comfortable with Putin (unless he’s sat next to his wife) and Trump (despite his dislike for chocolate cake).

Above all, he embodies that strategic patience and planning that the Zhou Enlai story (above) seemed erroneously to portray.

It’s ridiculous to consider that the sudden “peace talks” with North Korea’s Kim could happen without the encouragement and approval of Xi. Considered a surrender by some in China, Xi clearly sees it as a pawn in the long game.

He runs, and lives to fight another day.

So this time around, with a shaky economy that is reliant on the stability of a freshly purged social finance system and a manufacturing system having just had the handbrake of technological reverse pulled on it, Xi will don the Adidas shoes and buy American.

Act Two – Remember Three Mile Island.

So we saw, in Act One, that our premise is simply put – Xi will fold, and the US will declare a (Mickey Kantor-style) victory. Financial markets will breathe a sigh of relief, confused that this was THE issue that had been bugging them, and continue to torture the risk-shorts – more bubble and squeal from the “bubble of bubbles” brigade.

But what of the US side? Could they “go for broke” and over play a strong hand? Recent snubs of meetings suggests it’s possible.

They could, but as we’ll see, the US have their own “nuclear reactors at home” to worry about. They won’t want to see them burn through the Earth’s core any more than Xi. Remember Three Mile Island.

Bigger the better?

While China’s growth rate has naturally slowed as she’s matured, her contribution to global activity has swelled. In 1995 China amounted to only 6% of total global GDP. By 2013 that same figure (in PPP terms) had swelled to 15%. Today her contribution to the growth in global GDP is close to 28%.

For sure, China is now too big a baby, to have fall out of the bath. All would drown. For this reason alone, the US side will be happy with the phantom truce and expect the inevitable Chinese stimulus to keep the global party going, at least for another year.

2020 vision

While it’s fashionable to dismiss the Trump administration as a comedy, stepping back, one can see the accomplishments.

- The neutering of the more aggressive anti-ACA healthcare reforms, while still ensuring that historians (and therefore, with a long catch up, the economists) will determine that the original system couldn’t have worked and it died of natural causes.

- The first major reform of the tax code in over 30yrs, initiating a (greater than the economist’s estimates of) contribution to growth.

- Raising the prospects of a bipartisan infrastructure bill, that could provide medium term stimulus. It also adds to the engagement of the multinational corporations that the 10% tax amnesty began.

- The de-polarization of the US political landscape – forcing both the major parties to change their approach to medium term issues and perhaps even revolutionize their leadership – think from”weekend at Bernies” to AOC.

There are surely more, but in accomplishing these few, albeit tectonic achievements, the loss of the House last November looks to have forced a change of strategy. The infrastructure bill, our next “Shakespeare” plot, has been put on hold.

We will discuss the administration’s strategy towards multinationals here, in a forthcoming post (New Directions – the Fourth Turning into the Third Industrial Revolution), but the key point is that China is not the main focus of the Trump plan. Reining-in the multinationals, especially those with ambitions in China, is much more important. As we suggest in the above piece, the mantra is not MAGA, but instead MMAA – Make Multinationals American Again.

However domestically, a battle is needed, and already some generals have left the CiC’s side,

Therefore strategy has to change. and forces must re-group. Trump can no longer risk pressing home the advantage (that Xi needs the deal more than he does) and take more ground than’s offered.

The Chinese know this, and can expect their surrender of a few (trade) trenches to be gratefully received.

Xi will follow Napoleon’s advice – “never disturb your enemy while he’s making a mistake” as Trump focusses on the 2020 election.

Fed time at the zoo

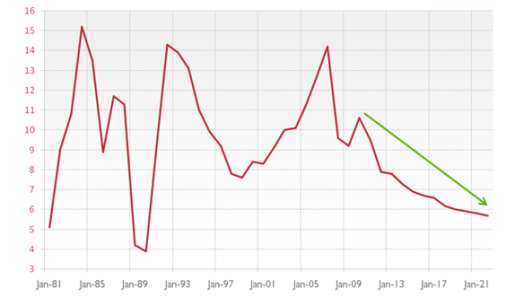

Given the US sudden weakness, and the inevitable, but far from calamitous financial instability, Trump will now rely on his Fed Chair appointee, Powell, to steer the Fed to a pause. As we discussed here, this pause will refresh the disheveled stock market, at a time where earnings have become challenged, and trade war fears have exacerbated risk premia on many fronts.

The prolonged closure of the government, and furloughing of a large number of paychecks, is quickly backfiring, and while the battle that must inevitably rage domestically could lengthen this closure, it’s not in either camp’s interest to remind the populace of previous shutdowns and debt-default calamities. Congress didn’t win those, and despite Trump, Congress won’t win this one.

While the Treasury’s coffers are swelled by new tariff-take, and presumably they can hold their breath longer than anticipated, the prospects of yet another debt ceiling and default battle only gild the idea that one day the default wolf will finally come.

Trump’s fiscal plans require greater fiscal latitude, not less, and belief in the sanctity of the Treasury Bond is essential to his success. Indeed, Mnuchin’s Treasury must be salivating at the thought of finally bringing home the US dollar market, after nearly 50yrs of watching Euro-dollar offshore dominance. The “death of the ibors” means exactly that.

Why mess it up? Come to papa.

Thucydides and his claptrap

But these largely financial and economic reasons to expect the US to play nice, will hardly assuage those who’ve read Graham Allison’s excellent book. Drawing on the fact that Ancient Greek historian Thucydides explained the inevitability of the Peloponnesian wars as “the rise of Athens and the fear that this instilled in Sparta that made war inevitable”, Allison concludes that the aging US superpower and the growing Chinese wannabe are following the same path.

“Over the past 500 years, these conditions have occurred sixteen times. War broke out in twelve of them. Today, as an unstoppable China approaches an immovable America and both Xi Jinping and Donald Trump promise to make their countries “great again,” the seventeenth case looks grim. Unless China is willing to scale back its ambitions or Washington can accept becoming number two in the Pacific, a trade conflict, cyberattack, or accident at sea could soon escalate into all-out war.”

An interesting narrative, laced with (ancient) history, and of course, 16 other examples. The technical analysts and fans of fibonacci will be salivating. History it seems, not only rhymes, but when there are 16 “modern” examples, it may even plain repeat.

But what Allison ignores, is the knowledge that the protagonists have read the play.

As we discussed above, Xi is a student of history and has commanded working groups be set up to fully understand the parallels of previous superpower confrontations. He will not make the same mistake Britain made in 1914, or in 1776.

Similarly, the US is full of scholars of military history. Mearsheimer, Joe Nye, Pillsbury, among others. And the list should include Paul Kennedy, who, albeit British, wrote the modern bible on superpower frictions.

The US has been here before – to say this is the first real challenge to US superpower status since Britain in the 1920s, is wrong. As well as the obvious Soviet Union, Japan was once on a collision course with her ally.

Obviously mistakes can be made. But our analysis above suggest that the issues are known and understood by both sides, and neither are currently strong enough to risk confrontation.

Conclusion – What’s mandarin for détente?

We’ve covered a lot of ground – it’s a complicated narrative. We tried to stay away from the deeply trodden, and most unsophisticated of arguments. We largely ignored the shadow banking system, the wasted investment, the cities with no people, China’s “bridges to nowhere”. We covered the Huawei debacle here, and resisted the temptation to re-open the case. Nothing is ever as it seems.

Instead we focussed upon the most commonly espoused arguments as to why China will collapse, why the US will try to push her over the edge, and why the US will also collapse as a result. Some people are never happy.

Our conclusions are orthogonal – while much of the criticisms of both economies could be correct, and may result in failure, there is no certainty. The US is a perfect example of an economy that started with debt/gdp in the low 10s% and ended up owing more than her income. She still reigns supreme, albeit a bit tottery.

China is quickly racing to adulthood – Anglo Saxon style. And with it, she has the scale to be truly systemic to the global (and therefore US) system. If (when) she can get foreign ownership of her debt into the 20-30% level that the US has long enjoyed, she will have employed what we call “Risk Transfer” – when you owe the bank a million you sleep restlessly, while when you owe a billion, the bank manager calls you sir.

China needs to reform, to transform her economy from one that’s reliant on trade, and the mercantilist fuel, to one that’s regularly 60%+ consumption. She has to open her markets to achieve that, if only to continue to acquire the technical know how to do so. She has to develop fiscal safety nets as her population ages.

She already almost looks like any other modern economy – she just has to start to “dress modern”.

For all intents and purposes, China is willing to “be bullied” to achieve the reforms she actually needs and wants to enact anyway.

“Ok Donald, let’s say you won”.

Epitaph 1 – AI in the sky

Back to Tocqueville – It is almost never when a state of things is the most detestable that it is smashed, but when, beginning to improve, it permits men to breathe, to reflect, to communicate their thoughts with each other, and to gauge by what they already have the extent of their rights and their grievances. The weight, although less heavy, seems then all the more unbearable,”

As Xi’s China attempts to reform, it will remain wary of this lesson. The centre falls when things are improving and loosening up.

The answer – technology, and Artificial Intelligence (AI), which will allow them to keep an eye on the rumblings. And according the the latest reports, that tech is arriving just in time. Indeed, and typical of Xi, locals in Hebei are encouraged to avoid debtor deadbeats using an app.

Perhaps don’t bet on a Chinese Revolution anytime soon.

Epitaph 2 – Who will win is virtually impossible to tell

While the next 12-18 months will only see the shoots of the AI-revolution breaking through the surface of both societies, on a five-year horizon, the whole landscape is certain to be dominated by the technological race for supremacy.

Many new concepts will undermine existing economic relationships, and disrupt commerce and government. Virtual reality, facial recognition, Blockchain, autonomous vehicles and machines, drones, AI-assisted services and experiences.

Anyone that tells you that they know how this will play out, whether the US or China, or perhaps another will come out on top, just laugh in their face.

And please note, these are all just Inflated Opinions of the authors. They should not knowingly be construed as investment advice.

yay google is my queen assisted me to find this great internet site! .

LikeLike